Broadway Ticket Sales Tax Has Been Proposed By Various New York City Mayors, But None Have Opted To Employ It, This May Change In The Future, Producers Will Likely Complain

Why Is There No Broadway Ticket Sales Tax?

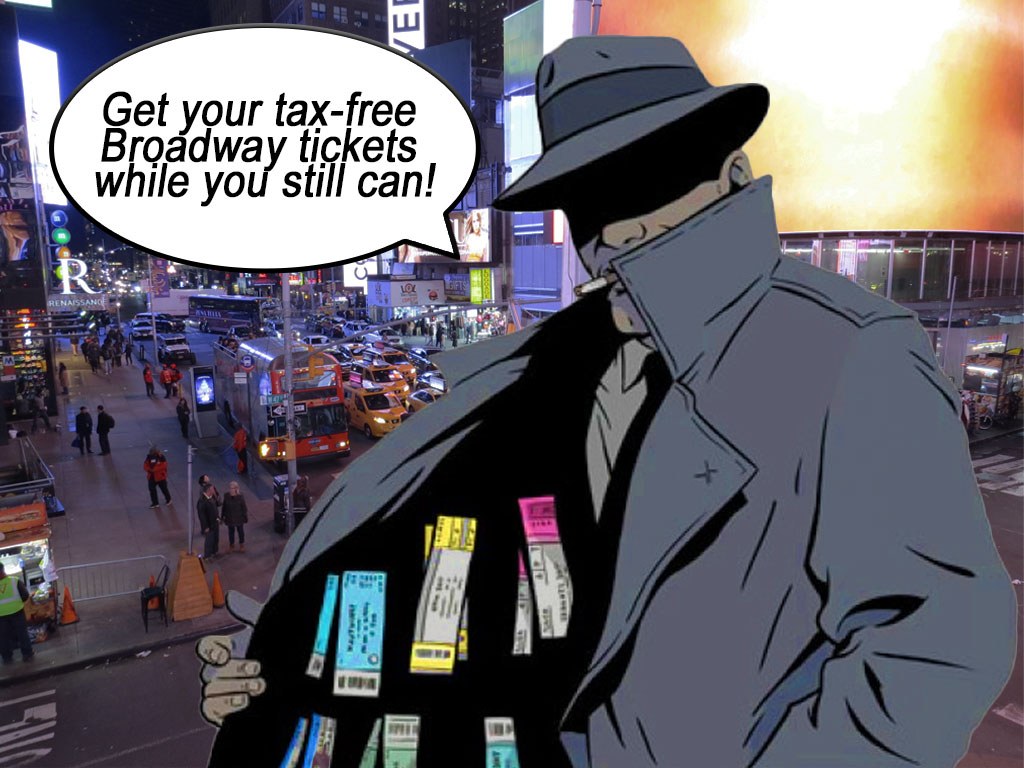

In NYC, there is currently no sales tax on Broadway show ticket sales. For everything else bought and sold in NYC, there is sales tax of 8%. The Broadway show industry has managed to persuade various NYC Mayors and New York State Governors to not kill the cash-cow that is Broadway theatre, by implementing a sales tax.

Over the last 100 years, various forms of taxation have been levied and then dropped against the Broadway theatre industry, but with recent ticket prices now getting out-of-hand, the city government is, once again, taking a look at instituting a sales tax on Broadway tickets and getting their hands on some of the huge revenue generated from Broadway show ticket sales.

Broadway League Push Back

Once in a while (and usually following a new person in office), the State Governor or the Mayor of New York City, eyes Broadway show ticket sales as a huge tax revenue but the Broadway League (the industry pressure group) has so far been able to push back, but with Broadway ticket sales now bringing in over $30 Million per week, the argument is getting harder and harder to justify.

It seems that everyone in Broadway gets paid and many top shows make huge amounts of money for the show investors, while other Broadway shows do not even come close to breaking even. NY State and NYC are left with making tax revenue from ancillary services, like hotels, restaurants and attractions and have yet to taste the fruit of its biggest tourist attraction.

How Much Could a Broadway Ticket Sales Tax Generate for NYC and NY State?

It is unclear what the impact of having a sales tax on Broadway tickets would actually do to the industry and the Broadway theatre as a whole, but charging a fixed 8% sales tax on Broadway tickets could generate more than $200 Million per year for the city and the state, without them actually providing any additional services. This is money-for-nothing for the government and is very tempting for them.

Tax-free sales in NYC are normally reserved for essential products like food and clothing, so its pretty amazing that Broadway, which is clearly is a luxury good, has so far avoided being taxed on their ticket sales. When Broadway tickets are sold by the primary official ticket outlets, sales tax could be applied and sent directly to the state, which is pretty lucrative at well over $100 Million in annual tax revenue on the primary ticket source, but this is only part of the equation.

Ticket Broker Resale Tax Also Offers Huge Tax Revenues

Every time a Broadway ticket is resold by a ticket broker, sales tax could be applied again and again, every time the ticket changes hands. Top Broadway tickets change hands on average about four times, before it finally gets into the theatregoers hands. This could mean that a Broadway ticket could ultimately pay more in tax than its own initial value, before it is actually used. This would not be just another $100 Million from the ticket brokers ticket sales, but far more.

The top five shows on Broadway bring in about $10 Million per week, which is one third of all primary ticket sales revenue. This equates to $500 Million per year, with a potential tax income at $40 Million per year. With these tickets being resold on average four times, that would bring in additional tax revenue from the secondary ticket brokers of about $160 Million per year.

Tax Only Paid By Secondary Market Brokers

This tax will not prescribe any extra pressure on the Broadway show producers, as this tax will only be paid by secondary market ticket brokers. This would also claw back some of the money that ticket brokers make from selling tickets over and over again for outlandish markups over the initial price of the ticket. The government sees no reason why NYC and NY state should not benefit from those subsequent ticket broker resales.

Total Broadway Ticket Sales Tax Revenue

The total potential sales tax revenue from Broadway ticket sales would be $100 Million from the primary sources and $160 Million per year from the secondary ticket brokers, resulting in a new income for NYC of $260 Million per year.

With ticket prices going up because of the new tax, less people would frequent theatre and NYC, but even with a reduction of 20% of traffic into NYC, the local government would still see over $200 Million in revenue and little change other taxable income sources including hotels, luxury goods, restaurants, parking and rental cars.

Other NYC Live Events and Their Ticket Sales Taxes

In comparison, most live events in NYC are already taxed. All shows at Nassau Coliseum are already taxed and sports events like the New York Rangers, New Jersey Devils, New York Yankees, New York Mets, New York Giants, The Islanders, The Nets and The Knicks games are also taxed on every single ticket sale and resale. Even season tickets and the US open tennis championships are already taxed, so why does Broadway get a pass? It may be down to the pressure that

The Broadway league can exert on the Governor and the Mayor. It appears that given the recent success of Broadway, both the Governor and the Mayor may finally cave and bring in the dreaded sales tax on Broadway show tickets that they expect. Industry pundits expect to see many complaints from Broadway show producers, but with the weekly numbers now pushing $30 Million, their protestations will likely fall on deaf tax accountant ears.